Read our extensive guides

Solar Panels

Everything you need to know about Solar PV

Heat Pumps

Move heat from outside to inside, with a heat pump!

EV Charging

Making the move to electrical transportation

Hydroelectricity and Microhydro

Learn all about the power of water!

LED Lighting

Energy saving lighting - brighten your space for less!

Biomass Boilers

Heating your home or business using biomass waste

Wind Turbines

Harnessing the wind to generate electricity

Solar Thermal

Heating water using the sun's energy

Start your journey

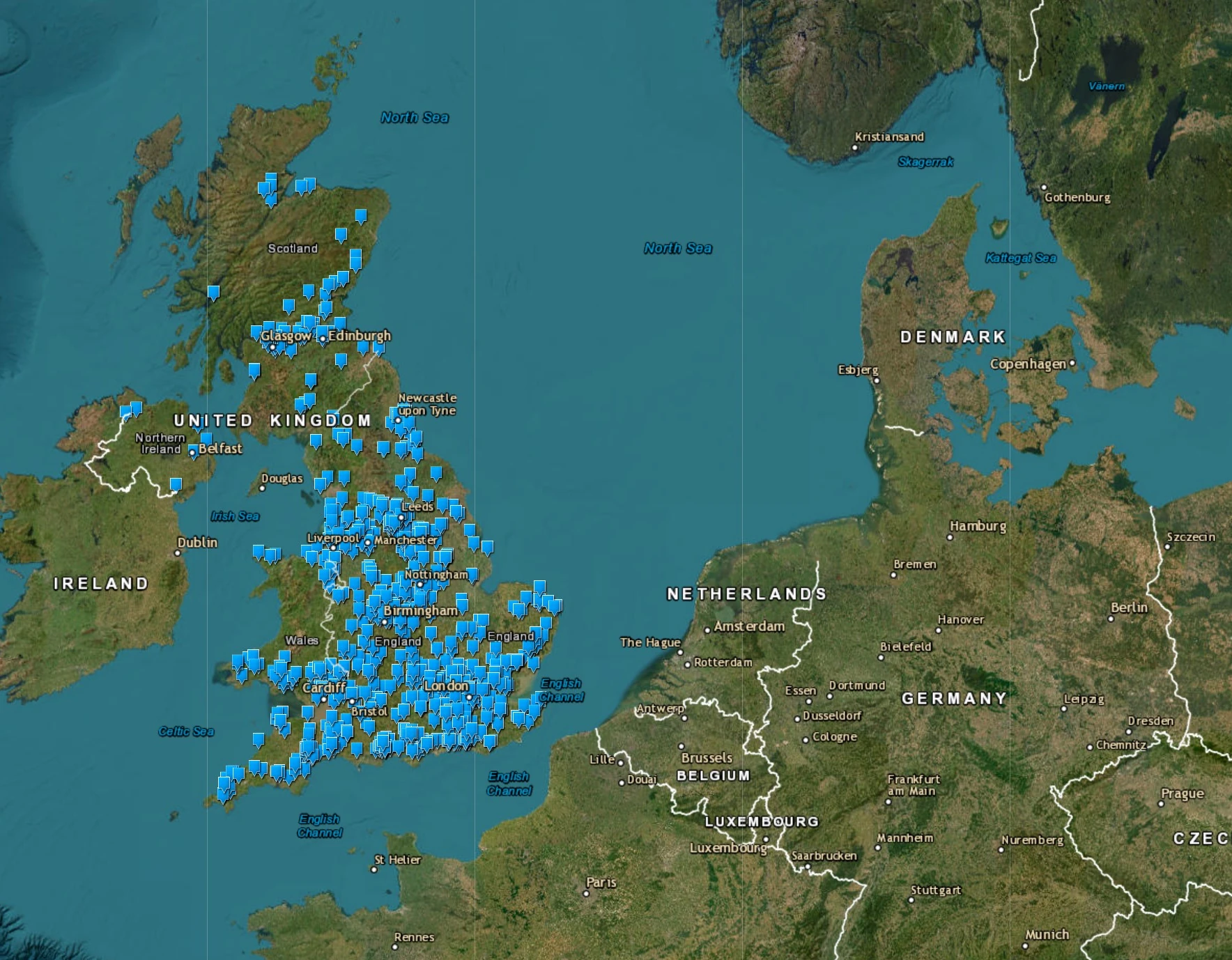

Our directory of installers and professionals gives you the power to find the right person for any job in minutes.

Browse for free, no sign up required

What do you want to do today?

I want to find a local reliable Installer

SEARCH HEREI want to research & learn about renewable energy technologies

LEARN HEREI want to buy renewable energy equipment

SHOP HEREI want to read your blog

EXPLORE BLOGSChat in the forum

TAKE ME THERECall to ask a question or get advice

CONTACT US

Trusted by millions of visitors globally

We are the No1 renewable energy community in the UK

31608

Registered Companies

1,500,000

Visitors a year

7,500+

Installations this year

8,962,500 Kg

CO2 saved this year!

1185

Members on the Forum

25,500,000 kWh

Electricity Generated

Renewable Energy Installers

Featured Installers

Sustain Heating & Renewables

7

Reviews

Sunbright Energy Ltd

23

Reviews

MD Energy Consultants

4

Reviews

Snugg Systems Ltd

2

Reviews

Cahill Renewables

6

Reviews

Get Listed Now

Recent Reviews

AEC Solar Division

Reviewed By John SimpsonA straight forward experience throughout. All members of the team were very professional and eff...

Taylor Solar

Reviewed By Manus McGonigleHaving received 4 quotes for our relatively complex residential implementation of ground mounted...

renewable green homes

Reviewed By AbdulGreat windows, great service, would recommend

CalTech Energy

Reviewed By Robert GribbenCallum provides a very professional service with a personal touch. His workmanship is very neat a...

Clique Energy Ltd

Reviewed By MR & MRS J SEDDONExcellent service from start to finish.

Clique Energy Ltd

Reviewed By MR & MRS D OLIVEA star service, would highly recommend, this company, neat and tidy and rapid

Clique Energy Ltd

Reviewed By MR & MRS M WinniczukBrilliant business. From to start to finish they were brilliant. Great job done and I save genera...

Clique Energy Ltd

Reviewed By MR & MRS R BaileyFabulous installation. Delighted with it. Lovely and professional people. Nothing was too much tr...

Clique Energy Ltd

Reviewed By MR & MRS P SAVAGEI had Tommy come and install my 6.3Kwp solar and batteries. His passion and enthusiasm for renewa...

Clique Energy Ltd

Reviewed By COLIN HOWESTommy and his team installed solar panels and a battery backup on my home. In the summer months,...

Renewable Energy Latest News

For over ten years our writers have been documenting the UK's efforts to transition to a brighter, greener future.

View All NewsFind your local solar and heat pump installers

- Aberdeenshire

- Anglesey

- Angus

- Antrim

- Ards

- Argyll and Bute

- Barking and Dagenham

- Bedfordshire

- Belfast

- Berkshire

- Blackburn with Darwen

- Bracknell Forest

- Brent

- Brighton and Hove

- Bristol

- Buckinghamshire

- Calderdale

- Cambridgeshire

- Carmarthenshire

- Castlereagh

- Ceredigion

- Cheshire

- Clackmannanshire

- Conwy

- Cornwall

- County Antrim

- County Down

- County Durham

- County Fermanagh

- County Londonderry

- County Tyrone

- Cumbria

- Cynon

- Denbighshire

- Derbyshire

- Derry

- Devon

- Dorset

- Down

- Dumfries and Galloway

- Dundee

- East Lothian

- East Renfrewshire

- East Riding of Yorkshire

- East Sussex

- Edinburgh

- Eilean Siar

- Essex

- Falkirk

- Fife

- Flintshire

- Gloucestershire

- Greater London

- Greater Manchester

- Greenwich

- Gwent

- Gwynedd

- Hackney

- Halton

- Hampshire

- Herefordshire

- Hertfordshire

- Highlands

- Isle of Wight

- Islington

- Kent

- Lambeth

- Lancashire

- Leicestershire

- Lewisham

- Lincolnshire

- Lothian

- Medway

- Merseyside

- merton

- Mid Glamorgan

- Midlothian

- Monmouthshire

- Moray

- Moyle

- Neath Port Talbot

- Newry and Mourne

- Norfolk

- North Tyneside

- North Yorkshire

- Nottinghamshire

- Orkney

- Oxfordshire

- Pembrokeshire

- Perth and Kinross

- Powys

- Rhondda

- Rutland

- Sandwell

- Scottish Borders

- Sefton

- Shropshire

- Somerset

- South Glamorgan

- South Gloucestershire

- South Tyneside

- South Yorkshire

- Staffordshire

- Stirlingshire