What are solar panels, how do they work?

In simple terms, solar panels use the power of the sun to generate electricity. Solar power is one of the most popular and well-known renewable energies. Although different kinds of solar panel exist, most work in a similar way. Solar panels collect energy from the sun through contact with daylight.

There are two basic iterations of solar panels. Although they all generate energy by converting rays from the sun, they do so in different ways. The two most common solar panels are:

-

PV or photovoltaic Solar panels

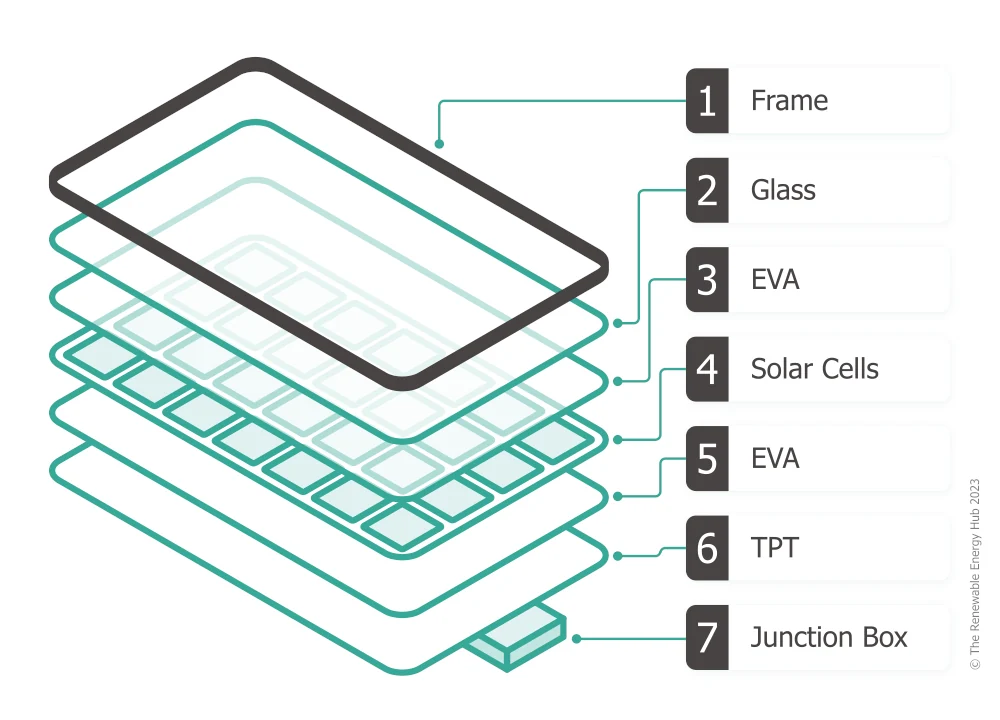

These are the most common domestic solar panels and the type you’re most likely to see on your neighbour’s roof. They work by collecting the sun’s energy via Photovoltaic cells and then using an inverter to turn the thermal energy into electricity. This process is possible because of how these photovoltaic cells are made. Each cell is a sandwich of different conductive layers, silicon being the most common. When the sun’s rays hit these layers, their varying electronic properties energise due to the protons in the light. This process creates an electric field. It's called the photoelectric effect and that’s what generates electricity.

-

Concentrating solar-thermal power (CSP)

While domestic PV solar panels are more common. CSP or concentrating solar-thermal power is often used in business. Although the energy comes from the sun, these panels work in a different way to PV cells and their use in the commercial world gives away why. Instead of relying on cells to convert sunlight into electricity, CSP panels use large, mirrored arrays to focus the sun’s power on a single point. This energy either becomes electricity or instead heats water to power steam turbines, to produce power. The benefit of the latter is that the heated water is useful for other purposes like thermal heating.

Are solar panels right for me?

There’s a good chance if you’re considering solar panels that you’ll be looking at PV or photovoltaic Solar panels. Of course, if you live in a vineyard in South Spain, your options may vary, but for most of us in the UK, PV cells are the obvious choice.

The next thing you may want to consider is the feasibility of installing solar. Simply put, if you don’t have enough space, an unobscured roof, the necessary permission, or the cold hard cash, you may want to skip solar. At least for now.

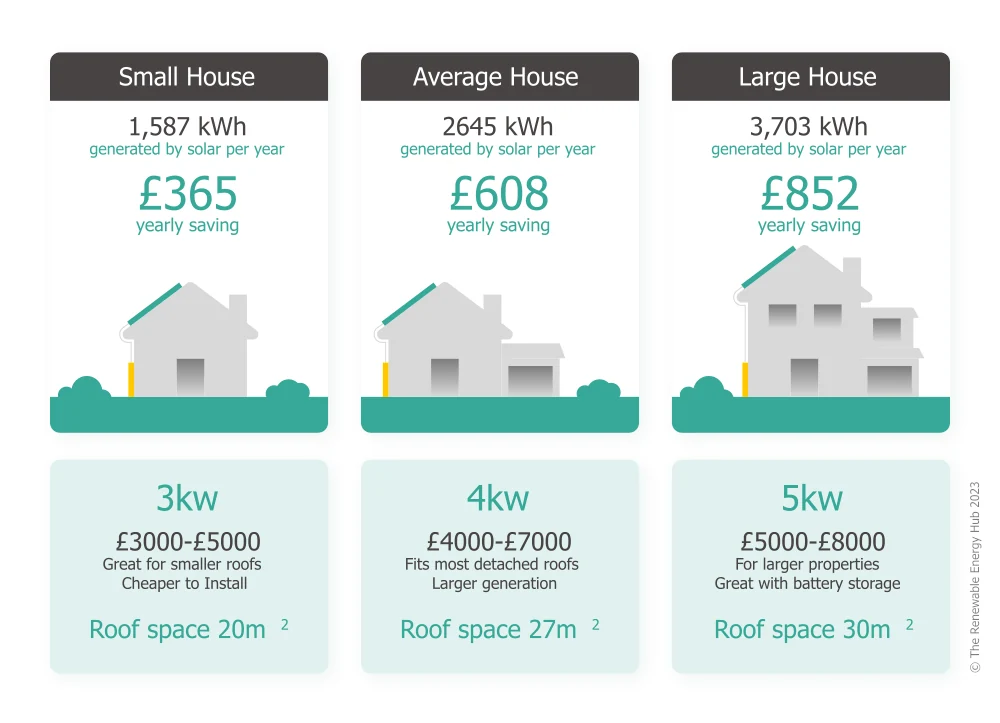

First up let’s consider the space. For an effective solar array, you’ll want about 20m2 of space on your roof. That would be enough to generate about 3.5kWp of energy under normal conditions and power the average UK house during the day.

Of course, space is not the only concern. Solar efficiency varies wildly depending on your location. If your house lies in the shade or doesn’t have a true south-facing rooftop, prepare for disappointment when your energy bills roll in.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

Next, there’s planning. Although planning isn't a huge hurdle, you can’t throw up solar panels anywhere. If you own a listed, or English Heritage property, or anything of that ilk, then unless you have friends in high places, you may as well give up now.

If it sounds like we’re being harsh, don’t worry. The truth is most homes are suitable for installation. Indeed, according to government figures the number of Solar Installations is going through the roof, pardon the pun. So far in the first quarter of 2023 over 50’000 homes got their first taste of solar energy, that’s double the number in 2022. In fact, 2023 now rivals 2015, when the government gave out solar subsidies like aunties and hankies.

Are solar panels suitable for my property?

We’ve touched on the basics of suitability, but in this article, we’ll take a deeper dive. Let’s start with three words.

South

For the greatest efficiency, your location needs to ace all these conditions. Take South for example. We all know the sun rises in the East and sets in the West. To make the most of that phenomenon you’ll want to place your panels facing south. As the sun rises, a south-facing roof should be in direct sunlight all day. The efficiency of your system depends on the orientation and type of roof your property has. For best results, those living in the northern hemisphere, need a south-facing sloped roof. This should be free of obstructions, but we’ll come to those in a moment. If your roof is south-facing, but pitched, rather than sloped, then only half of the roof will be in direct sunlight in the morning. As the sun reaches its apex, both faces will be in direct sunlight. As it draws into evening,only the western half of your roof will be in sunlight. It’s still possible to generate solar energy in this scenario, but the system will be less efficient than a sloped roof.

Shade

Next, you need to consider shade. For peak performance, you want direct sunlight for the maximum period. Shade is bad news. Now, the odd patch of shade might not be a deal breaker. For example, if your TV aerial only casts a tiny shadow for an hour or two a day, then you could live with it. Solar panels work in series, but they have fail-safes built in to keep power flowing around dead cells. If your roof lies in the shade of trees, other buildings, or your chimney for long periods of the day though, then you may want to reconsider the placement. It’s also worth mentioning that the built-in failsafes to protect you from roosting pigeons and the like will still cost you efficiency.

Space

Speaking of space, a big part of your system’s efficiency will come down to the area your panels occupy. There are lots of online calculators to help you determine how many panels and how big your system needs to be. The orientation and type of roof you have can affect the space your system requires. I.e. a south-facing sloped roof will need fewer panels than a south-facing pitched roof to generate the same amount of energy.

Failsafes, micro inverters, and optimisers.

Now, if you don’t have the ideal orientation, the perfect space, or there’s shade where you’re hoping to install your panels, don’t panic yet. If your situation isn't ideal there are a few tricks you can try to improve the efficiency of the system. Two of these are microinverters and solar optimisers. The principle here is to amp panels that have suffered power loss due to shading. These days most units have built-in bypass circuits in the event shading causes one or more cells to fail. That said, optimisers and micro-inverters can further improve the efficiency of affected cells.

As a rule though, if you can: face south, avoid shade, and use all the space you have.

What kind of roof is best for Solar Panels?

The type of roof your house has will play a part in how efficient and how feasible solar panels are for you. The main factors to consider are:

-

Roof types

Let’s look at the different types of roofs first. The best roof for solar panels is a large sloped square roof, free from obstruction with a south-facing aspect. Most roof types are OK for solar installation, but things start to get tricky when you have ridges, chimneys, and other fixtures or fittings.

-

Orientation

We’ve discussed orientation before, but it’s such an important factor to consider that it deserves its own section. As discussed, the ideal orientation is south-facing. Although, anything other than a north-facing roof will be able to accommodate some form of solar system.

-

Roof material

Like other factors, the material of your roof plays a part in the feasibility of a solar installation. Although often to a lesser degree than other elements. The ideal material for an installation is asphalt or composite shingles. The reason is simple, as the most common material in the UK for standard roofs, most solar installers come prepared for shingles. The upside of this means there’s no need for specialist equipment, fixtures, or labour and the extra costs. Another common roofing material is slate or tile. Like shingles, your provider won’t need any extraneous fittings or equipment to install the panels. Another widespread roofing material in the UK is bitumen felt roofing. These roofs are often flat or flatter than the more traditional style. This is often seen on extensions and outbuildings. They are still suitable for solar installations but may need special brackets to correct the panels' angle. As with anything in life, adding to a process amps the price. That said, these roofs are often lower and offset added costs by reducing the amount of scaffolding required. In the UK, most of the common roofing materials are suitable for solar installation, but there are two major exceptions. Thatched roofs and wooden roofs are so problematic you may as well rule them out. Thatched roofs in particular are impractical for solar installations. Even if you were able to find a provider willing to carry one out. Wooden roofs are also unsuitable, but you may be able to find a workaround if you have your heart set on solar and you don’t have another option. There are other roofing types, but most of these are more common on commercial properties and that’s another story.

Where’s the best location in the UK for a solar installation?

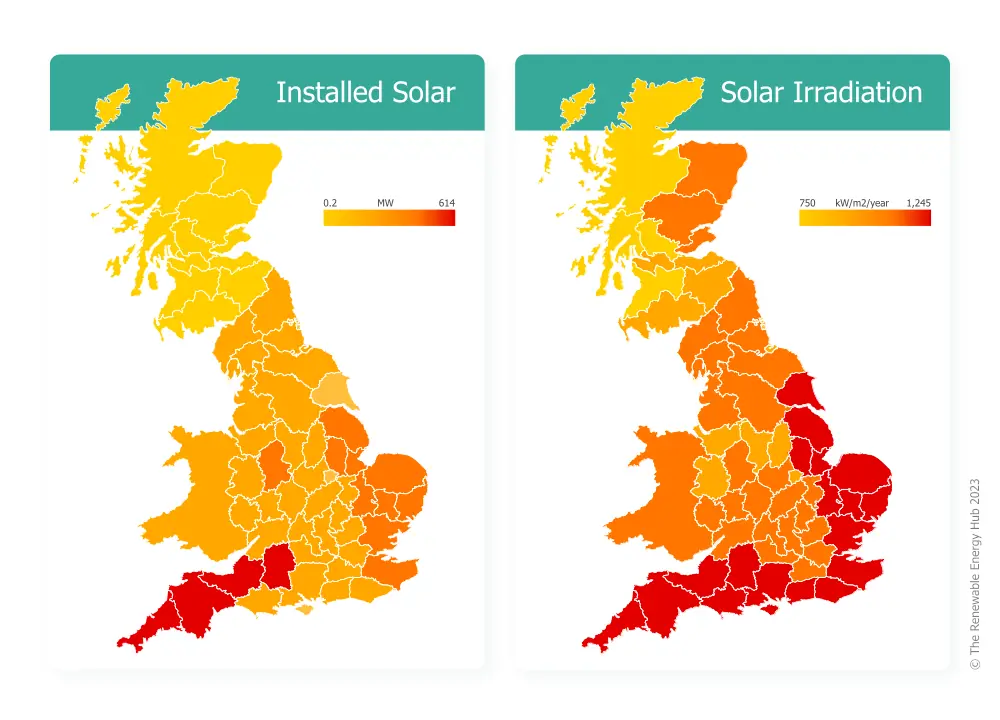

In answering this question, it’s worth remembering efficiency may come down to the other factors we’ve already discussed. IE. Orientation, shade & space. In short, a well-placed solar system in a less sunny area may provide more energy than a less ideal system in a sunnier location. It’s also worth considering the average costs of energy. Expensive places to live like London can offer a better return on investment than say somewhere like Cornwall. This is because although there's less sun than in Cornwall and the unit cost of energy is so much higher. Now, we’ve established that, let’s look at the hot spots according to data from the Government’s regional renewable statistics database.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

-

Best city for solar:

As you’d expect the south coast fares the best with the city of Brighton and Hove taking the top spot for sunlight and return on investment. It’s also worth mentioning that the city boasts the UK’s only Green MP, Caroline Lucas. In addition, until 2023 the city also had a majority Green council, which it recently lost to Labour. Even still, the city’s politics suggest that renewable energy projects in the city are less likely to face red tape than in other boroughs.

-

Best county for solar

In county terms, Cornwall is the solar king with an impressive 18076 active solar installations. The rest of the list reads as you might expect. The Southcoast takes the top slots, but one surprising statistic is how far down the list areas like Scotland and Wales sit. Of course, lower population density plays a part. That said, with so much rural space, remote locations, and the need for less traditional energy solutions, you’d think solar would be more popular. The sad truth is Scotland sees less sunshine than other regions. It does lead the UK in Hydroelectric and Tidal power though. Most of Wales though is no further north than East Anglia, which boasts almost twice the number of active solar systems.

The below image gives an idea of the solar capacity installed in the UK and the solar irraditation for each county.

What solar storage is best for you?

Before considering what battery storage system suits your household, you’ll need to work out how much energy you use. There are many ways to do this, but the simplest is to ask your current energy supplier. There are also many online sites and tools that can give you the average UK usage. There are also sites where you can find out the average usage of any given appliance. For the sake of convenience in this article, we’ll use the current figures from OFGEM.

According to them, the average UK household uses about 8-kilowatt hours of energy a day. Now, it's worth remembering that energy usage is seasonal. We use more power in winter for heating and lighting and less in the warmer months since the days are longer and the climate is warmer. These figures represent an average family of four in a medium size house. Larger, and smaller households will use more and less energy respectively.

After you’ve worked out your energy consumption you can begin the search for a suitable storage option. Apart from usage, you’ll need to factor in other elements like cost, reliability, and lifespan. Like solar inverters, solar batteries tend to have a lifespan of around 10 years. Like inverters though, as the technology improves their lifespan and reliability will increase.

It may surprise you to know that energy storage solutions are occasionally used by people who don’t own solar panels. The point of their batteries is to take advantage of cheaper tariffs available in off-peak hours. Their batteries work in much the same way night storage heaters do. There’s also the option to earn money by providing storage to energy providers when the grid is producing excess energy

-

Advantages

- Store unused power for use when the panels are ineffective (like at night)

- Earn potential revenue for storing excess power from the grid

- Power on demand

- The ability to store low-cost off-peak energy from the grid

-

Disadvantages

- The cost of a storage system can be prohibitive

- Storage cells have a shorter shelf life

- The complexity of solar storage systems

- No benefit once the system is at capacity

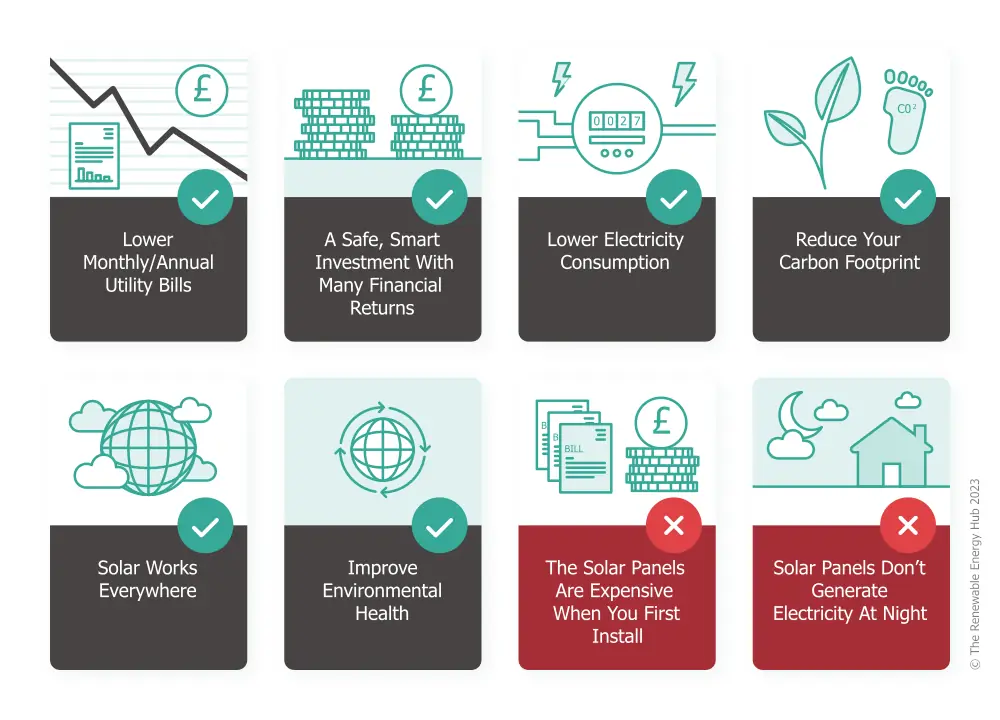

What to think about when considering a solar system

If you can afford it, and it’s a practical option for your property, installing solar energy may sound like a no-brainer. Like everything in life though, there’s more to it than that. So, before you race ahead, here are some things to mull over before getting the credit card out.

Solar energy is a lifestyle choice

You need to know that to make the most of your new energy system you may have to change your lifestyle habits. If you can afford a hoofing great solar power plant, a pile of batteries, and live in a sun-drenched property with the ideal roof, then this may not apply to you. For the rest of us mere mortals, though, get ready for some hard truths. Yes, once your energy is reliant on sunshine, you’re going to need to work around daylight. This means washing your clothes during the day and being careful what appliances you use at night. You may need to eat earlier in winter and rethink your physical appliances due to their energy rating.

Solar energy is less abundant in winter… when you’ll need it more

It’s true, during those glorious hot summer days you’ll have all the hot water and heating you don’t need. On those cold dark December nights, though, you may find yourself Googling hot water bottles and thermal blankets.

The solar energy market is ever shifting

This means it’s a good idea to keep an eye on prices, upgrades, warranties, emerging technology, incentives, and tariffs. What’s true one day might not be the next. Be careful signing yourself for long-term contracts and fixed-rate tariffs. Every week, new gizmos and gadgets emerge that could boost your output or increase your efficiency. So, keep yourself looped in and follow the latest trends, movers and shakers, and reliable news outlets.

There are ways to game the system

As a new industry, you may find loopholes, hacks, and workarounds you can abuse. What you choose to do with this information is up to you, but we would always advise our readers and customers to stay on the right side of the law. Examples of loopholes include signing up for subsidised low-cost overnight energy for electric vehicles but diverting that energy to your solar batteries instead. There are other examples, but you get the idea.

There’s more to a solar system than a few panels

Don’t forget all the cabling and extra equipment like inverters, controllers, and storage. Most installations look the same, but if you want something neater and less in your face, expect to pay for the privilege.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

What else could go wrong?

Life is an imperfect place, and anything can happen. Storms can damage your panels, birds, and other animals can mess with your cables. Your warranty should cover big issues like damaged panels and cabling problems. Provided you tell your insurance company about your solar system (and if you haven’t, do it now!) the system itself likely falls under your building's insurance.

Costs and savings for solar panels

How much does a solar panel system cost?

If your house is suitable for solar installation, the next thing you’ll need to consider is the cost. You’ll hear a lot about the prohibitive prices of installing solar, but you need to factor in the benefits the panels can bring you. The truth is, if done right, it’s often possible that even borrowing the money to install solar power can cost less than your current energy bills.

The actual cost can vary depending on the size of the system, your location, luck, and the current demand. That said, you should set aside somewhere in the region of £5000 for a full installation. Five grand should be enough to cover the standard 3.5kWp system we mentioned above.

The core costs of installing solar panels are usually broken down into three separate areas. The panels themselves, the inverter, and the battery system, but it should also cover the wiring, the installation, and the cost of labour. You may need to up your budget if your property has awkward access or needs extensive scaffolding.

Before considering a solar installation it’s a good idea to work out how much electricity you use, and how much you’ll be able to generate. Finding out how much power you use is simple, contact your current energy provider and ask them. Next, you need to work out how sunny your house is. If this sounds like a big ask, don’t worry, it’s easier than it sounds. Thanks to the European Commission, there’s a tool called the Photovoltaic Geographic Information System. It’s an international visual database that collects and collates the latest potential solar energy anywhere in the world. It’s a bit cumbersome, but you should be able to work out the potential energy you can generate using different-sized arrays. There are helpful websites out there that can show you how to use the system if you get stuck.

Another factor you’ll have to consider is maintenance. Solar systems are lighter on maintenance than other renewable energy sources like wind turbines. However, you’ll still need to keep them clean and watch for damage from falling debris. The life cycle of a solar system is around 25 years. This is also the benchmark warranty term from most suppliers. They may last a little longer, but it’s a good lifespan to consider if you’re thinking of adding one. One factor to remember is that the inverters have shorter lifespans. On the plus side, they tend to be a bit cheaper than the rest of the system. Anyhow you can expect to shell out £500 to £800 somewhere around the halfway mark of your 25-year warranty, which won't cover the inverter. In brighter news, you can be certain inverter technology will have improved by then and you may end up with a more efficient system, a lower price, or both. Another maintenance consideration is tree surgery. This will depend on your system's proximity to trees and shrubs. It may not affect you at all, but trees and bushes grow and if they start casting shadows on your panels, you’ll want to nip that in the bud, so to speak.

What is the return on investment?

As mentioned above, the return on investment from a solar installation can vary thanks to many factors.

The efficiency of your system

The efficiency of your system is the greatest factor. EG, panels on a south-facing roof with no shading are more efficient and cost-effective than twin sets of panels on east and west-facing roofs.

The cost of installation

How much you pay for your system also influences your return on investment. If you’re lucky and negotiated well your system could be up to 25% cheaper than a comparative system. The best way to maximise value is to get many quotes and then try to bring down the cost of the system you want to the lowest price. Common sense dictates that if two identical systems cost £5000 and £7500, the former will have a better ROI.

The offset of potential subsidies

Keep your ears and eyes peeled for subsidies, grants, and offers in your area. There are organisations out there, willing to help fund renewable energy projects like solar systems. Grabbing an incentive like that can ramp up your return on investment.

Weather conditions

Ah good old Blighty. If there’s one factor, we can’t control it’s the weather. Solar panels work better in direct sunlight. If it happens to pour down for a month straight, it’s going to affect the numbers.

The amount of energy needed

You’ll likely have considered how much energy you need. Sure, you can sell excess power back to the grid. Yet, whether that’s enough to cover the cost of a massive, excessive solar system for you and the cat is another matter.

Good old-fashioned luck

Like the weather, we can’t control fate. What if gale-force winds take your array offline for a month? Or a stray cat decides to rewire your invertor? What if the kid next door trips your entire circuit with his drone? Expect the unexpected and remember it’s all going to take a toll on your investment

How long will it take for your solar panels to pay for themselves?

By now, you don’t need us to tell you about mitigating factors. Suffice it to say the time can vary. On average though a typical system can pay for itself in about ten years. As costs go down and reliability and efficiency go up, this number will come down, indeed, it’s worth factoring in potential improvements. Of course, if your system is inefficient, you’re plagued with maintenance issues, you chose poor tariffs, or you overpaid… then you can add a few years.

Current solar incentives

Smart export guarantee (SEG) and Feed In Tariff (FIT)

One factor you’ll need to consider is the different ways you can get money back for the excess energy your system generates. Now, solar is an emerging technology so keep the shifting political landscape in mind. It’s worth noting this section and the details herein, may change and change often. It’s a good idea then to make sure you have the latest data. The information provided here is correct as of June 2023.

Let’s start with FIT

The UK government launched FIT or the Feed in Tariff in 2010 and replaced it with SEG the Smart Export Guarantee in 2020. Since new applications for the Feed in Tariff closed in 2019, we mention it here only as a legacy tariff. This is for anyone thinking of taking on a property with an existing solar system still on the tariff. Payments via FIT come in two forms. First, a lower tariff for the total number of units generated by the system, and a second higher fee for energy fed back into the grid. The plus side is that the tariff generously estimates the latter figure to be half of the energy your system generated.

Smart Export Guarantee or SEG

Oh, how they love their acronyms. Anyhow, as mentioned SEG replaced the Feed in Tariff in January 2020. As you may have gleaned from its title The Smart Export Guarantee only pays for the energy you export. It’s worth noting that different energy providers have different tariffs for the SEG payments. Plus, remember if you don’t sign up for the scheme, you’ll be giving away your energy for free. SEG payments work out by comparing the energy you generate versus the energy you use. There are two distinct tariffs under the SEG umbrella, fixed rate, and variable. Fixed rate is as it sounds, but the variable rate depends on the time you sell your energy, as demand and supply drive the price up and down. Both SEG and FIT are tax-free, but if you’re considering a new installation, you can pretty much ignore the Feed in Tariff since the door’s now closed.

Solar panel costs, grants, and ROI

In this section, we’ll answer the fundamental question of how much a solar panel system costs. We’ll also discuss any currently available grants, as well as look at some historical grants for context. Finally, we’ll discuss the expected return on investment.

-

What does solar cost?

As you’ll appreciate, having read other articles on this page, the price of a solar array can vary due to many factors. Everything from your negotiating skills to the suitability of your property to your energy needs will play a part in the final tally. As a rough guide though, we’ll look at a typical installation, for the average UK family. Taking current figures, as of June 2023, the average cost of a standard 4kw system for a typical 3-bedroomed house sits between £6500 and £7000. You can add between £600 and £800 to install such a system. For your cash, you can expect a 16-panel system, inverter, cabling, and storage, with a 20-to-25-year warranty depending on your supplier. That’s enough power for an average family of four using current energy-efficient appliances. For smaller families and homes, you can reduce the number of panels to 12 and lower the cost by £1000 to £1500. As discussed throughout, there are many mitigating factors that can affect the price.

-

What grants and incentives can I get?

Once again, we’ll remind you that the solar energy market is swift moving. It’s always worth checking current and pending rules, regulations, and legislation. As of today, June 2023, there are scarce few grants, and those that do exist have strict criteria. Still, the current incentives are available.

Solar Export Guarantee (SEG)

We’ve discussed this before, and we’ll do a deeper dive a bit later, so, we won’t spend a lot of time here on it. While SEG is not a grant as such it is a financial incentive to move to solar. SEG is the UK government’s current commitment to Solar energy. Launched in 2020 it replaced the more generous Feed In Tariff (FIT). Under SEG, solar owners can sell their unused energy back to the grid and different energy providers offer differing rates. Therefore, it’s a good idea to check who’s offering the best rates. Unlike FIT which rewarded solar owners for every unit they generate, SEG only pays for units you don’t use yourself. It makes sense then that the more efficient and the higher capacity your solar array has the more you’ll earn from this tariff.

0% Vat on Solar Systems

This initiative arrived in 2020 and runs until 2027. There are a few carve-outs and caveats, but in essence, the government has removed VAT from solar systems. As we said there are a few carve-outs, solar batteries for example are not covered by the scheme, and there are some regional restrictions too. If in doubt, check with your local authority.

Home Upgrade Grant 2 (HUG2)

As you’ll have spotted governments love an acronym and HUG2 is one of the best. HUG2 launched earlier this year and runs until 2025. It’s managed by local authorities and each one sets their own criteria. This is a move to help lower-income, lower energy-rated households make energy-saving improvements to their homes. This in turn helps lower carbon emissions and improve the general state of the environment. Eligibility for HUG2 changes from region to region, but most councils will consider a grant for a solar installation. HUG2 can cover the entire cost of your installation.

Energy Company Obligation 4 (ECO4)

Now in its fourth iteration, this incentive launched in April last year (2022) and runs until 2026. ECO is one of the longest-running initiatives. First launched in 2013 as an incentive to encourage energy providers to help households make the switch to renewable energy. Like HUG2 it’s aimed at lower-income families. Both homeowners and anyone in the rental market can apply. Unlike HUG2, ECO4 is a national grant, and the application criteria are universal. The scheme covers insulation, efficient heating, and solar panels. Successful applicants are eligible for up to 100% of the cost of a solar array.

The LA FLEX initiative

Less of a full-blown incentive and more of a tag-on for the ECO4 grant, The LA FLEX is short for Local Authority Flexible Eligibility. It’s an amendment to the ECO4 scheme. During the rollout of ECO3, and its strict and obscure eligibility criteria, too many applicants found themselves in limbo. The LA FLEX is the government’s attempt to plug that void. It works by giving local authorities added funds and leeway to cover these loopholes and get more people involved. The grant, like ECO4 and HUG2 is available to low-income households. But, it also covers folks with relevant medical conditions, and properties with poor energy efficiency.

Rent-a-roof and solar buyback

These initiatives are less common these days as they focussed on the government’s previous incentive scheme The Feed in Tariff (FIT). We mention them here for context, but there are still a few solar buyback offers out there, although we covered them in the Green Deal section. Rent-a-Roof was a thing during the early ‘solar boom’. Some companies realised the potential to turn a profit from the Government’s lucrative (FIT) Feed In Tariff. To get in on the action, these firms paid for the installation of solar systems in exchange for a heavy share of the revenue. For consumers, it was a good deal since back in those early days there were grants and incentives a-go-go and lots of cash to go around. This meant that even when paying back the cost of the installation, savings were still possible. Deals and details varied, but those days are in the past. If you’re looking to buy a property that has a solar system, you may want to check the fine print to see if you'll end up liable for any outstanding costs.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

What kind of savings can you expect?

Switching to solar will save you money. How much you can save depends on the many factors we’ve discussed before. We won’t go over covered ground, but remember that the more efficient, suitable, and sunny your home is the bigger savings you can expect. For the sake of this example, we’ll choose an average-sized house, in an average location, with an average system. In the UK typical households save between 40 to 50% on their energy bills upon switching to solar. As discussed, some properties may net savings closer to 60%, while others might struggle to hit 30%. In real terms, the average household could see a reduction of anywhere from £200 to £600 in their annual energy bills.

-

An ongoing battle

These savings will improve over time too, as energy prices and solar panel efficiency rise and the costs of installing solar panels fall. It’s worth remembering, that how you use your system and how savvy you are with the market can also make an impact on your potential savings. If you forgo the odd late-night Bovril, make the most of the daylight hours, and keep your pulse on the latest SEG tariffs, you can make a difference. Making the most of your system will help you nudge your numbers towards that 60% saving, even if you live in a less-than-perfect spot.

DIY, lo-tech, and portable solar systems

So far, we’ve discussed complex domestic and commercial solar systems. For clarity, this means professionally installed systems with all the trimmings. As mentioned, the price of these systems varies. As a rule, though, let’s say this includes anything with a two-grand plus price tag. Not all solar systems fall into this category though and now we’ll look at some of the low-cost options.

-

Localised solar systems

First up, let’s look at small solar arrays designed to power a specific area. These installations may power a workshop, garage, shed, or whatever. Smaller systems don’t need or have extra elements like a feed into the grid, so, there’s no way to sell your unused electricity. Typically, a local solar system designed for this purpose will have one, two, or three solar panels at best. Storage-wise, a local solar system will often use a leisure battery or in bigger systems a series of leisure batteries. Leisure batteries are 12-volt batteries, like car batteries, but designed to drain and recharge over time. Car batteries, by contrast, don’t cope well when drained and if used like that have a shorter shelf life. You’ll often find leisure batteries in caravans, mobile homes, and boats. Depending on their needs, some local solar systems won’t have storage at all. Their main function could be recharging the batteries of other devices like power tools and the like.

-

DIY solar panel systems

-

As a nation, we Brits are well known for our shed-based ingenuity. From our humble garden workshops, we’ve given much to the world. In the UK today thousands of DIY disruptors tinker with all manner of projects daily and solar power is one of the most popular. Despite the rise of the solar industry, or indeed because of it, all the components needed to make your own homemade solar system are available to buy. Going your own way can save you money but expect to make up for that in effort. As a note of caution, designing and installing a solar power system is a dangerous undertaking. Electricity is not a force to mess about with. While we’re not your mum, we do feel it’s our responsibility to advise anyone without the appropriate training to leave it to the professionals. That said, all the required parts and components are commercially available.

-

Low-Tech solar systems

There’s one type of solar panel we haven’t discussed yet, low-tech thermal panels. Now, a note of caution, what follows may lead you down a rabbit hole. In simple terms, any process or gizmo that uses the sun’s energy to create or store energy is in some way solar-powered. To use the simplest example of all, if you laid a big terracotta pot out in the sun all day and then took it inside at nighttime. The heat radiating from the pot thanks to the collected heat makes it a thermal heater. Lo tech thermal solutions all use a similar principle. In fact, if you think about it polytunnels and greenhouses, and underfloor heating are solar-powered devices. Here's an example of a solar water heater powered by an old fridge and here’s a link to a legendary US magazine famous for wild homebrew energy plans. Some projects are more complex than others, but it’s fascinating to see how many ideas and concepts there are out there.

-

Portable solar systems

As the technology improves, we’ll see more of these gizmos on the market. What started out as rechargeable power banks for devices like smartphones have, in recent months edged into the domestic market. The outdoor, camping, and hobby market is still the obvious target market. However, some of these options boast impressive numbers. With 2000 watts output and 1500KWH batteries they're approaching the power of smaller domestic systems. Clearly, there's no potential for selling energy back to the grid, yet. Used with care though, smaller households could see significant reductions in their energy bills by using these devices for at least some of their energy production.

The efficiency of solar panels

Efficiency is a word you’ll hear a lot when considering solar panels, and the most important aspect of any system. But how efficient are solar panels and is there any way to improve them?

Hosepipe dreams

Getting the most energy out of your system comes down to many factors. Everything from how you organise your day, to your lifestyle choices, to the weather will affect it in some way. How efficient your solar panels are then is the most critical aspect of all. Think about it, if you think of your solar panels as the taps on a sink. Then it doesn’t matter how careful you are with the connected hosepipe. The truth is, the most fundamental factor in watering your garden is how much water comes through the tap.

The only way is up

Solar is still an emerging technology and improvements are happening all the time. As more and more consumers get on the solar train, more and more money will flood the field. With this influx of capital, researchers and disruptors will make better and better improvements. It’s safe to say then, as time marches on, the efficiency of solar panels can only grow. All this enthusiasm does lead us to a simple question though. What are the folks in the white coats up to and how are they planning to nudge the numbers? We’ll get to that in a mo, but before we get back to the future, we need to know where we are right now!

State of the art

As of today June 19th, 2023, the most efficient domestic solar panels on the market boast an efficiency of 22.8%. What's more, there’s more than one manufacturer making that claim. To put that in perspective, last year, there was a clear leader offering a panel with an efficiency of 22.6%. Now, that 0.2% nudge may not seem like an epoch-defining leap, but remember, the better we get at something, the harder it is to improve. The real success story here is not the improvement, but the fact that there’s more than one maker pushing the boundaries. You may also like to know that back in 2021, the most efficient panels barely scraped the 20% barrier. Save your party popper for now though, because it looks like everything is about to change... again...

The shape of things to come

As we said earlier, Solar energy is an emerging technology. So, the jump in solar panel efficiency between 2022 and 2023 was a mere 0.2%. It looks like that number wasn't cutting it though. This year, according to the mainstream media, a South-Korean company will launch a game-changing solar panel. Their commercially-available perovskite-silicon tandem solar cells boast an efficiency a shade under 30%.

Perovskite-silicon tandem solar cells

The secret sauce behind the new panel is a material called perovskite. Perovskite, like silicon, is a crystalline substance with impressive energy conversion potential. Cheaper and more abundant than silicon, scientists and engineers have experimented with it for years. Until recently, the material despite its excellent photovoltaic properties, proved too fragile for commercial use. This new concept though appears to meld the new crystal with silicon to create a robust cell. As with all new technology, perovskite-silicon cells are likely to be expensive in the short term. History teaches us though that it won’t be long before the costs plummet. In the meantime, it’s exciting to think that solar panel efficiency has jumped almost ten percent in a couple of years.

The shape of things to come

As we said earlier, Solar energy is an emerging technology. So, the jump in solar panel efficiency between 2022 and 2023 was a mere 0.2%. It looks like that number wasn't cutting it though. This year, according to the mainstream media, a South-Korean company will launch a game-changing solar panel. Their commercially-available perovskite-silicon tandem solar cells boast an efficiency a shade under 30%.

Best location

Bright sunlight and more of it is ideal and yes, the UK does have enough to warrant the installation of a solar thermal system. However, you will need a backup system for those cloudy bank holidays and for winter. In the UK, you can expect such a system to provide approximately 50 to 60% of your domestic hot water requirements.

Solar Installation and maintenance

How are solar panels installed?

As mentioned above, concentrating solar-thermal power, or CSP for short is another method of harvesting the sun’s energy. Due to the cost and the space required to install such a system these arrays are often only employed on an industrial scale. It’s often the case that the energy they generate is a core part of the business. Such as solar farms.

The quote

The first step for any installation is getting a quote. The solar market is on the up and you’ll find plenty of companies happy to compete for your business. Part of this quote process involves a site visit. As the quotes come in, you’ll get a sense of the work required. During this stage, engineers will survey your property. Here, they’ll highlight the best locations and options for the panels and the system. Decent companies often provide a proposal based on the potential energy you need and the size of the system you need. Some may also present architectural-style drawings of how the system will look.

Making the right choice

Finding the right supplier is essential. As a renewable energy comparison site dedicated to a carbon-free future, the Renewable Energy Hub is the ideal place to start. You’ll find almost every reputable energy supplier in the UK listed in our database. Our users can search for the best solar panel providers by address and postcode or check out our supplier’s map. Our vast, living database updates daily. It includes contacts and reviews for the best renewable energy providers. Also, it hosts a wealth of useful online tools and resources laser-focused on the renewable energy industry.

Planning

Once you settle on a good supplier, the planning process follows. In the UK, planning processes vary from location to location. Factors, like listed building status or English Heritage, may also affect your plans. This process can take anywhere from a few weeks to months. Most solar arrays don’t need planning permission, but if you do need it the process should be painless. Once you secure planning permission, you’ll need to finalise what your system looks like.

Aesthetics

It’s important at this stage to discuss your personal aesthetic preferences. Remember, a solar system is more than a bunch of panels. Networks of cabling connect each panel to the inverter and the batteries. This all requires cabling. Deciding on the best place for the rest of the system can determine the required cabling. You may decide to opt for a different location and less obtrusive cabling, to make the system blend in better. In short, you need to consider all these factors before proceeding.

Scaffolding

Once you’re happy with a supplier, the installation can take place. It’s likely the engineers will need scaffolding to set up the panels. They will already know what fittings they need for your roof, and you’ll have discussed the best place to install your array.

Installation

Fitting a solar system can take anything between a day and a week depending on its size and complexity.

Strike down and handover

Once your system is up and operational, engineers will remove the scaffolding and clear the site. Then it’s time for you to sign off on the work and enjoy your new array.

How easy is a solar system to maintain?

Compared to most energy sources, which draw power direct from the grid, solar is a breeze to look after. Most systems come with twenty-to-twenty-five-year warranties. There’s a reason suppliers are so generous with their guarantees, solar PV systems have few working parts.

What’s required to keep your solar system running?

Keeping the lights on requires ensuring the panels are clean and free of debris. It’s worth looking for a local specialist solar panel cleaning company. Your supplier can often recommend someone. You can do it yourself if you’re not afraid to get on a ladder. Though as you’ll only wash them once a year, even hiring a pro won’t break the bank.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

Batteries and Invertors

Solar battery systems

If you have an off-grid system, a solar battery system is a must, but these days most solar PV systems include some form of battery or power storage options.

Like most emerging technology the price of solar storage is likely to go down while the efficiency rises. Right now, there are many kinds of electrical storage solutions. These range from simple leisure battery circuits like you might find in a caravan or a cabin cruiser, to next-generation lithium unitswith more kilowatt storage capacity than most homes could use in a day.

How much do batteries cost?

We’ve done the pros and cons of solar storage and touched on the types available. Now it’s time to talk about the money. We’ll ignore simple leisure battery circuits for now since we’ll cover those later under DIY / lo-tech installations. For now, let’s focus on the big boys. Today we’re talking about the wall and rack mounter beasts you never knew you needed.

1.5 to 3 KWH

Decent solar storage systems start around the £2 grand mark. For that kind of money, expect installation included and a 1.5 to 3 KWH capacity. That’s fine for smaller households, but you may have to ration those late-night coffees in winter.

3 to 5 KWH

For bigger systems, you won’t get much change from £5 grand, but at this price expect a name-brand solution, installation, and a 4 to 5 KWH capacity.

6 KWH+

Anything north of 6 KWH will cost you £6000 to £7000. At this price expect industry-leading features, decent customer service, and a lengthy guarantee.

10KWH+

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

Massive capacity 10 KWH+ batteries do exist. You can pick up lesser-known brands for £5000 and over, but on average expect to pay £7000+ for this kind of capacity. Also, at this level, solar storage often comes with built-in inverters and other features.

Invertors: how is solar converted into electricity?

An inverter, as the name suggests, is a device that changes one form of energy into another. In the case of solar energy, this means inverting direct current (DC) to alternating current (AC). Without getting too technical, most household appliances need alternating current (AC) to function. The raw energy collected by your solar panels, however, is direct current (DC).

These days solar inverters do a bit more than AC/DC inversion. Solar inverters can also manage the system. Your inverter will also control the battery system and operate as a communicator between your system and the grid. The inverter is, in many ways, the brain of your solar system, and most important of all, the failsafe that protects the whole array.

-

Different kinds of inverters

Depending on the scales of your system there are a few inverter variants you may come across.

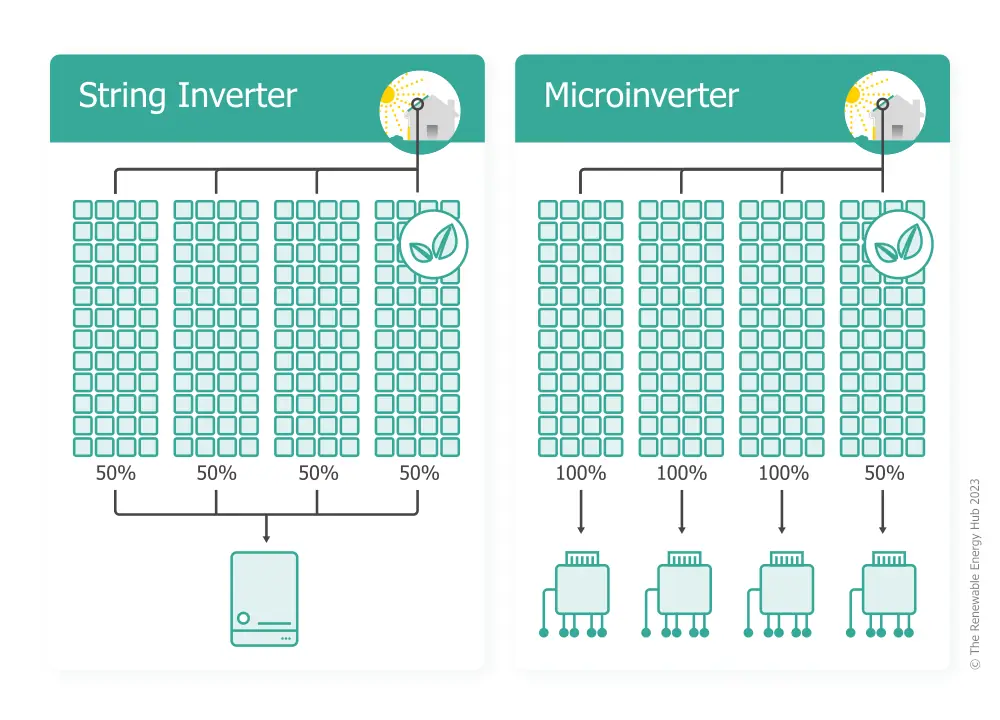

Central inverter

In large, or medium-sized, systems, each panel in the array connects to a central inverter. This single unit oversees the entire system and all that involves.

String inverters

In some arrays, particularly those involving multiple panel sets, you may find string inverters. These devices each control several panels independent of the others. These string inverters then in turn feed into a central inverter.

Micro inverters

We’ve discussed micro-inverters before. These are little devices that sit between individual panels and operate to boost the efficiency of the array. They're designed to increase efficiency in the event of power loss through shading, or other factors.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

Solar Thermal System

What is solar thermal and how does it work?

In basic terms, Solar thermal systems use the sun’s energy to heat water. There are variants, but most systems work in the same way. Panels collect energy from the sun. This energy heats up a transfer fluid which feeds a heat exchanger. Here, the transfer fluid heats up water in a boiler, or emersion heater before going back to the start.

What does it do and how is it different from a traditional solar system?

Solar thermal systems work in a different way from PV solar cells. Although both systems have 'solar panels', the energy collected by a solar thermal system does not create electricity. Instead, the system generates heating and hot water.

-

Components of a solar thermal system

A solar thermal system uses panels, but they are unlike the PV cell panels found in traditional solar systems. The correct name for these panels is collectors. Collectors are the primary component of a solar thermal system. Solar thermal panels use reinforced glass pipes to capture the radiation from the sun. These insulated pipes contain a special liquid called transfer fluid. Transfer fluid features an eco-friendly antifreeze so it can capture heat and circulate through the system. Once the fluid is hot enough it passes through another significant part of the solar thermal system called the heat exchanger. As the name suggests this device allows the heated fluid to transfer its heat into a water tank. Some systems have a single water tank, while others have two. These tanks are both heated in the same way, but the water inside is for different purposes. i.e. drinking water or heating etc. A control unit manages the whole system which in turn runs a pump to keep the fluid moving.

Solar thermal V’s solar PV system which is cheaper?

This equation is not easy to calculate. It’s true that the initial cost of installing a solar thermal system is lower than a traditional PV system. Yet, the savings and potential earnings can make a PV system a better investment in the long haul. Based on figures from Checkatrade, you should budget £4000 to £5000 for a solar thermal system and £5000 to £8000 for a solar PV system.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

Different Types of solar panel systems

Ground-mounted solar panels

If you don’t have a suitable roof, don’t panic there are alternative ways to install solar panels. Ground-mounted panels being the most common. You’ve likely seen these types of panels on a drive through the countryside since ground-mounted solar panels are often used in solar farms. Despite being more common for commercial energy providers, ground-based PV Panels also work for domestic use.

The different types of ground-based solar panels

Right now, there are two kinds of ground-based panels. Both use typical PV panels, and the only difference is their fixtures. The most common are standard ground-mounted panels. These, as the name suggests, sit on custom-fitted brackets driven into the ground. These brackets allow the panels to tilt and sometimes rotate to maximise their efficiency over the course of the day. The other type of ground-mounted solar panels fit onto elevated poles. These pole arrays often carry many panels. Some even come with smart tracking systems that allow the panels to rotate as the sun moves across the sky. Maintaining a direct line of sight with the sun can be a game changer in efficiency terms. These systems present a good return on investment.

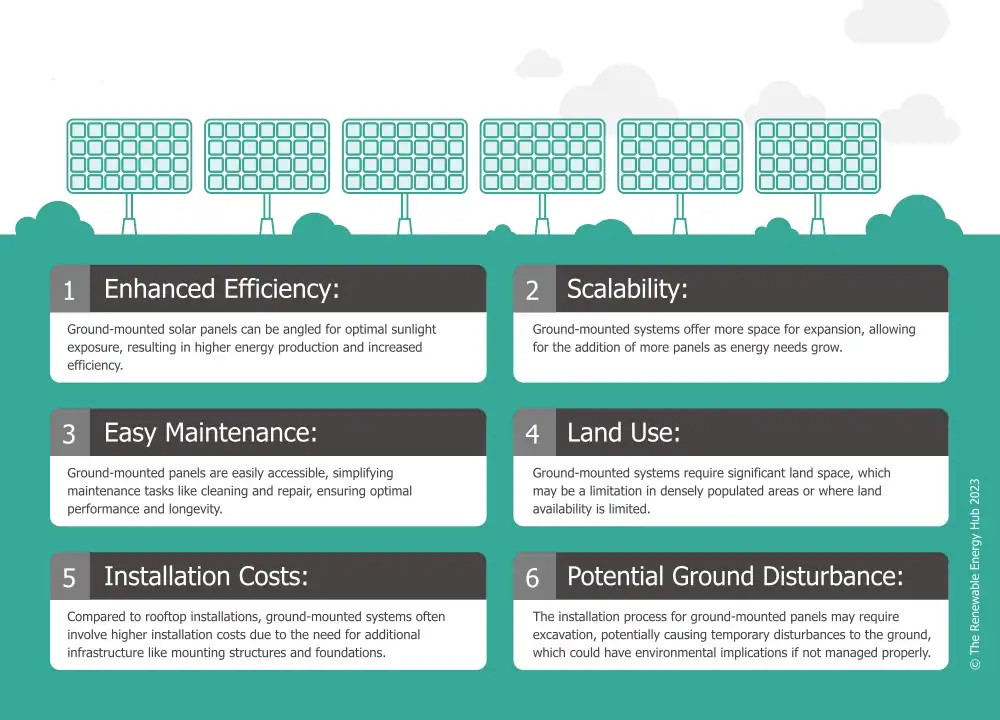

Pros and cons of ground-based solar systems

There are always upsides and downsides to most investments and ground-based solar arrays are no exception. On the plus side, such a system allows homeowners without suitable roof structures to enjoy the benefits of solar power. Ground-based solar panels are also easier to maintain than their rooftop cousins. After all, it’s a lot easier to remove detritus like stray leaves, snow, and other debris at ground level. So, you might find installing a ground-based solar system is as, if not more, expensive than a rooftop version. particularly if you opt for extras like a tracking system. You may also find that your ground-based solar array system is more prone to damage. After all, it’s a lot easier for debris to fall on your equipment when it’s at ground level.

Off-grid solar arrays

One of the undeniable boons of solar power is its potential for off-grid power generation. If you’ve ever dreamed of a Butt’n’Ben, a bothy, or even your very own Mongolian yurt in the wilds of the country then this section is for you. Of course, it will also help if you want to get power to your shed, summer house, or garage and don’t like red tape or trailing extension cables.

Solar power can be a viable off-grid option, but to make it work 24/7 you’ll need decent battery storage. Solar power by its nature relies on sunlight, which in the UK is often unreliable and, of course, seasonal. For the greatest efficiency and to make the most of the sunlight, you’ll need to capture, convert, and store as much energy as possible.

Advantages of off-grid solar

- Off-grid solar can bring power to the remotest locations.

- An efficient off-grid system is immune to traditional power cuts and brownouts.

- A robust off-grid solar system can be cost-free.

- It’s a good way to learn more about solar power.

- You should be (mostly) unaffected by shifting rules, regulations, and legislation.

Disadvantages of off-grid solar systems

- Unless you can afford a large and super-efficient system, you’ll need a secondary energy source.

- You’ll need to keep the array free from obstructions.

- Power will fluctuate in autumn, winter, and early spring.

- You’ll get zero support from energy providers and the national grid.

- There’s zero potential to earn money by selling your excess energy.

- In total, a true off-grid system can cost a small fortune.

- You may need to use lower-powered appliances or go without.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

Commercial solar panels

Commercial solar panels

We’ve discussed domestic solar systems at length, but it’s also worth looking at the commercial side of the market.

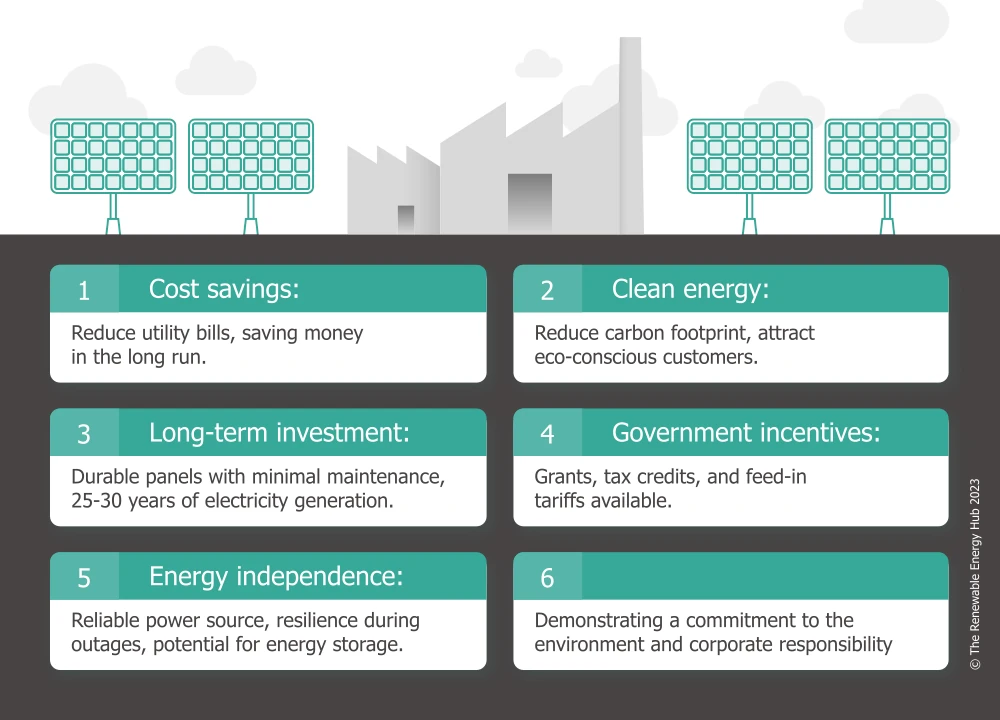

As a business, there are four clear reasons to install a solar energy system:

Money

Lowering your outgoings is a no-brainer. Unless cash flow is a problem, a solar system will almost certainly save you money. How long it takes to see a return on investment is the only variable.

you're unlucky with maintenance, weather, and initial costs, you’re sure to save versus a traditional energy supply.

Reliability

Keeping the power on is also a key factor in considering a commercial solar installation. Having your own independent energy supply shields you from power cuts, brownouts, and energy price swings.

Environmental concerns

This is another reason to opt for a commercial solar system. There are many benefits, grants, and regulations surrounding renewable energy. After you make the switch to solar, you’ll likely find yourself eligible for all sorts of advantages, rebates, tax breaks, and more.

Public relations

Public opinion has swung in a wide arc toward renewable energy and more and more consumers are speaking through their bank balances. If anything, the movement is growing in momentum, and slower renewable energy adopters risk losing customers.

Types of commercial solar systems

We won’t waste time trying to re-explain the wheel. Suffice it to say many businesses use both Solar PV and solar thermal systems. The only real difference here is the scale of these installations. You'll often find commercial properties, except for some retail businesses, in less regulated areas. It’s also common for commercial premises to be larger. Therefore, with more roof acreage and less red tape to contend with, the size of some commercial solar systems trend toward the gargantuan. There’s also another type of system that we’ve discussed before that is suitable for larger commercial operations.

Concentrating solar-thermal power (CSP)

As mentioned above, concentrating solar-thermal power, or CSP for short is another method of harvesting the sun’s energy. Due to the cost and the space required to install such a system these arrays are often only employed on an industrial scale. It’s often the case that the energy they generate is a core part of the business. Such as solar farms.

Monocrystalline vs polycrystalline

PV solar panels account for most domestic and some commercial solar installations, and there are two variants. The easiest way to think of them is regular and deluxe.

Polycrystalline: is the no-frills panel and as the name suggests, they contain multiple layers of silicon. They begin life in an oven that melts crystalline fragments. Formed into cubes, they are then sliced into wafer thing cells. As polycrystalline cells consist of many different crystals their efficiency suffers. On average, they achieve 12 -13% efficiency, lower than their more expensive monocrystalline cousins. Polycrystalline panels are blueish in colour. You can recognise them from their distinctive rectangular cell matrix.

Monocrystalline: is the PV gold standard. Unlike polycrystalline cells, a wafer-thin slice of a single silicon crystal comprises each cell. These lab-grown ingots, prized for their excellent solar properties have great efficiency. The average lies between 15 -20%. Some newer cells show even greater efficiency, with experimental versions approaching 50%. Monocrystalline panels are darker in colour than their cheaper counterparts. They look almost black to the naked eye. You can tell a Monocrystalline panel by its octagonal cell structure, which looks a bit like a honeycomb.

Each panel has its uses and pros and cons

Polycrystalline Panels

Pros

- Cheaper than their monocrystalline cousins

- They last as long as monocrystalline panels

Cons

- It takes more polycrystalline panels to produce the same energy as a monocrystalline array.

- They are less energy efficient

- Their production is more impactful on the environment

- Their blueish colour is more garish than monocrystalline panels

- They don’t cope with heat as well as the more expensive panels

Monocrystalline Panels

Pros

- High energy efficiency

- Systems need less space

- Their black colour blends in easier on most roof surfaces

- They cope well with heat

Cons

- The cost

- Availability

Whether you opt for monocrystalline or polycrystalline solar panels is likely to come down to your budget. If you can afford them and if you can find them, monocrystalline solar panels are the obvious choice... unless you happen to have a blue roof.

COMPARE PRICES FROM LOCAL INSTALLERS

Compare prices from local companies fast & free

Enter your postcode to compare quotes from leading professionals. We promise to keep your information Safe & Secure. Privacy Policy

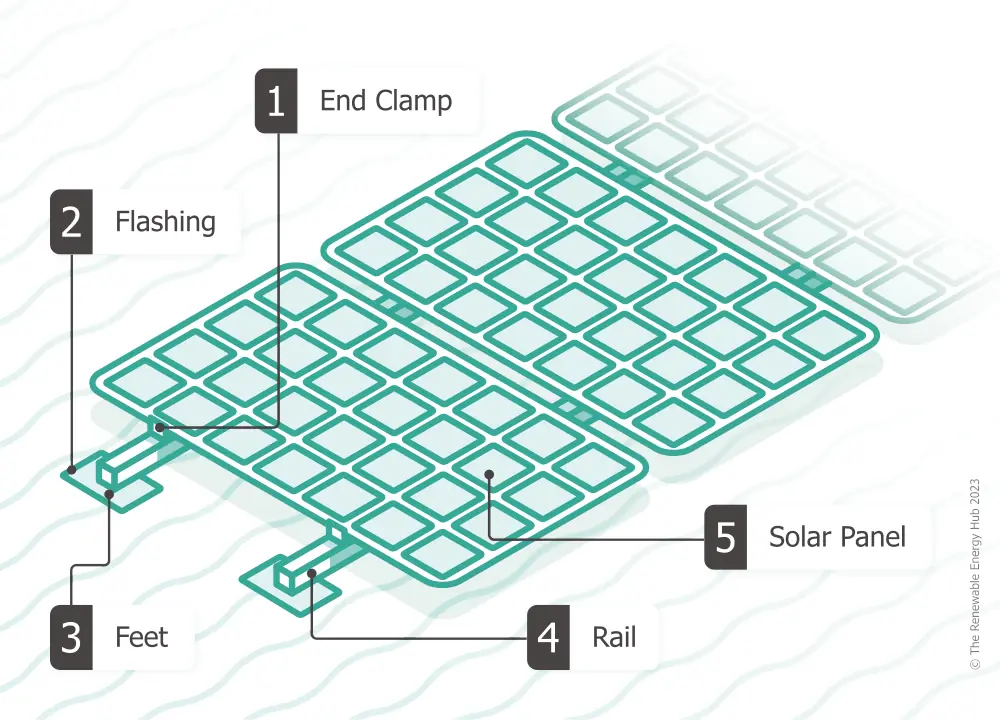

Solar mounting systems

Solar panels are suitable for a variety of applications, but each scenario comes with its own set of fixtures and fittings. The two main types of installation are roof-based and ground-based. We’ve discussed the various versions of each before, but let’s look at the practical applications in depth.

-

Roof-based solar installations

How your panels attach to your house depends on the kind of roof you have. For the best efficiency, solar panels should face the sun. This is easy on sloped roofs and only requires the appropriate kind of bracket. Solar engineers carry brackets for all roof types. Although depending on your preferences and budget, some may be obvious while others are discrete. On flat roofs, though, a solar panel installation needs special racks to maintain the correct orientation and angle. These rack systems often cost more than simple brackets, but they can be more efficient. In some cases, it's possible to add features like automatic tracking and tilting to ensure the most efficient orientation. These added features don’t come cheap though.

-

Ground-based solar installations

If your property is unsuitable for a rooftop installation, you could try a ground-based system. Whether it's down to planning or location issues, ground-level panels can get around these problems. You might think that without scaffolding, ground-based solar systems are cheaper to install but, this is seldom the case. The reason for the added costs is the extra infrastructure needed to mount a ground-based solar system. There are two main variations of grounded solar systems, rack-mounted, and pole-mounted. Rack systems, as the name implies, need engineers to fit a special structure to hold the panels. This rack may need physical foundations and it’s not uncommon for engineers to dig out and lay concrete anchors to support the array. The second ground-mounted solar array needs a vertical pole to support the panels. Like the rack-mounted options, engineers first lay concrete foundations to secure the pole. This gives it enough strength to support the array. Like roof-mounted rack systems, ground-mounted solar systems support automatic tracking and tilting systems. This is more common on pole systems, and as with the roof rack arrays, come with a hefty price tag.

Well, that was a lot of content. If you've read through it all then you'll be pretty well informed if the topic comes up at the dinner table.

The increasing efficiency of the technology and widespread uptake is helping improve air quality and combat global emissions but aside from that, the technology can also provide an attractive pay-back period and co-generation can give you a good degree of energy independence.

Hopefully we've helped answer any questions you have. We go into more detail on specific subjects, just click the further reading links on the right if there's something you're particularly interested in. Alternatively, we're available 9-5, Monday to Friday for a chat and you can always contact us via the contact us form.

Find a local installer

Welcome to the biggest directory of UK renewable energy companies

How Much do Solar Panel Systems Cost in 2024?

How Much do Solar Panel Systems Cost in 2024?